4 Creative Ways People Are Making Homeownership Happen in 2025

4 Creative Ways People Are Making Homeownership Happen in 2025

Let’s be real, buying a home in 2025 doesn’t look like it did five or ten years ago.

Prices are up, rates are still higher than we'd like, and if you're a first-time buyer trying to make it work in a hot market like Henderson or Las Vegas, it can feel a little overwhelming.

According to the 2025 NextGen Homebuyer Report, nearly 60% of Gen Z and Millennial buyers believe homeownership is attainable, but only 19% think now is a good time to buy.

But here’s what’s interesting nationally: instead of waiting for some “perfect” time to buy, a lot of folks (especially Gen Z and younger Millennials) are finding creative new ways to get it done instead.

Here are four of the most creative paths buyers are taking right now instead of waiting. If you're serious about buying, but the traditional route feels out of reach, one of these might actually work better for your situation.

1. Buying a Fixer-Upper

📊 Used by 42% of buyers in a recent survey - That is a lot!

Henderson is full of beautiful renovated and newer move-in-ready homes, especially in neighborhoods like Inspirada or MacDonald Highlands. But if you’re handy (or have some solid contractor connections), scooping up a home that needs a little work can be a smart way to land in a great area at a lower price point. Especially if it is a home that functions great, but just needs some cosmetic changes to bring it into today's more sought after looks.

Pros:

-

You’ll pay less upfront

-

There’s serious equity potential

-

You can make it your own

Watch out for:

-

Renovation costs can spiral

-

It takes time so there's no instant gratification

-

Not every loan works for fixer-uppers if it needs major renovation

💡 Pro tip: Ask about renovation loan options like the FHA 203(k), they let you roll renovation costs into your mortgage.

2. Co-Buying With Friends or Family

📊 Considered by 21% of all buyers, 32% of Gen Z

This one’s becoming more common than you’d think. Especially with how fast prices jumped during the pandemic boom. Whether it’s siblings buying together, or two friends splitting the down payment and monthly costs, co-buying can give you double the purchasing power.

I’ve helped a couple of buyers go this route here in Vegas. Just know: it’s not a handshake deal. I highly recommend you need to get everything in writing, from who’s paying for what to what happens if one of you wants out. Get. It. In. Writing.

Pros:

-

Shared down payment = easier entry

-

Bigger budget = better location

-

Built-in support system

Be careful with:

-

Clashing financial goals

-

Relationship strain

-

No legal agreement = disaster waiting to happen

3. House Hacking

📊 Used by nearly 1 in 5 buyers

You’ve probably seen this on Instagram or TikTok - buying a home and renting out part of it to help cover the mortgage. It could be a casita, a basement apartment, or even a room you list for rent. Airbnb can be challenging in the Las Vegas Valley btw with restrictions, permits, and HOAs, but you can still find other routes for landing a roommate.

In Henderson and Las Vegas, some newer homes have separate entrances or guest suites that are perfect for this. Anthem Highlands, for example, has some larger floor plans with potential for this strategy with a little remodeling.

Why it works:

-

You’re building equity and generating income

-

It helps offset your monthly payment

-

You’re turning your primary residence into an investment

Downsides:

-

You’ll need to check local zoning laws

-

Tenant/Roommate management isn’t always easy - you give up privacy and not for everyone

-

Many of the homes that have specific "NextGen" suites can be pricier (not typically ideal for a first time home buyer)

4. Relocating to a More Affordable Area

📊 Considered by 47% of buyers

One of the biggest shifts since 2020? People are way more open to moving if it helps them buy. And with remote work sticking around, that flexibility is creating a lot of opportunity.

I’ve helped clients relocate from various parts of California, Seattle, Washington, and even New York because Henderson and Las Vegas give them more/newer homes, better taxes, and a lower cost of living, all without much lifestyle sacrifice if any.

Why it’s smart:

-

More square footage for the same budget

-

Lower property taxes

-

You can build wealth faster

But keep in mind:

-

You might be farther from friends/family

-

Some areas appreciate slower than others

-

You’ll want a trusted local expert to guide you (👋🏽 that’s me)

Final Thoughts

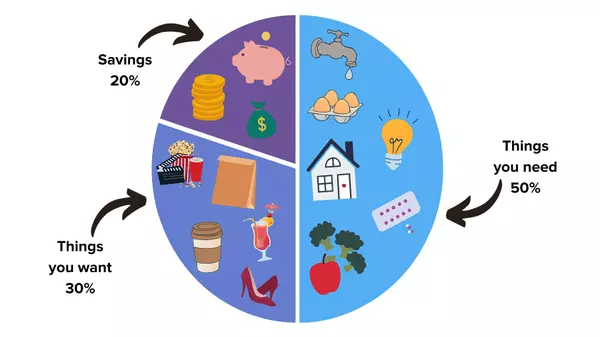

There’s no one “right” way to become a homeowner in 2025. But there is a right way for you. Whether that’s buying with a friend, getting creative with income strategies, or relocating to a more affordable part of the valley, your options are way more flexible than you might think.

If you want to explore your options or get clarity on which path might make sense, you can always reach out to me. Or if you're just getting started, grab my Homebuyer Kit—it’s a free resource packed with everything you need to make smart moves in this market.

Categories

- All Blogs 25

- Affordability 5

- First-Time Buyers 5

- Henderson Real Estate 11

- Home Buying 21

- Home Selling 3

- Las Vegas Real Estate 7

- Market Trends 6

- Market Updates 6

- New Construction 4

- Real Estate Tips 4

- Relocating To Las Vegas & Henderson 5

- Relocating To Las Vegas & Henderson, NV 2

- Relocation Advice 4

- Summerlin Real Estate 1

Recent Posts