How Will Mortgage Rates Impact The Las Vegas Housing Market?- 4th Quarter 2025

What To Know About Mortgage Rates - 4th Quarter 2025

As a real estate agent, mortgage rates have been a major topic of conversation for residential real estate over the past few years. As recently as this past May, the average mortgage rate was at and even above the 7% mark. Recently there has been a teend downwards. According to Mortgage News Daily we are currently at an average moragegrate of 6.29%. A mark we were last at in October of 2024. The ease in rates since just this past May could impact a mortgage payment by over $200 a month. That is some impactful savings over the course of the year. With the FOMC (Federal Open Market Committee) having a high likelihood of a cut to the fed funds rate at it's next meeting September 17th, what can we anticipate for mortgage rates moving forward? Also, what does that mean for someone ready to buy a home?

The Fed Funds Rate Isn’t King of Mortgages

It is important to know when you hear the fed and fed funds rate being talked about on the news, it is not mortgage rates. They are two seperate things. The fed funds rate more directly affects short term rates such as credit cards or adjustable rates. That's not to say when the fed funds rate moves down, rates won't also move. It just might not be at the same amount of adjustment. We've also seen mortgage rates move up slightly after an adjustment down to the fed funds rate. This can be because rates are trying to factor in upcoming decisions that are likely to come. So in our current scenario where the Fed has implied it is likely we will see a rate cut at the next meeting, mortgage rates start to price that in.

The 10 Year Treasury Yield Is Closer In Line With Mortgage Rate Movement

If you'd like a better read on what mortgage rates are doing, follow the 10year treasury yield. They follow a very similar trajectory. So as the 10 year rises and falls we generally see similar from mortgage rates. Recent data from the job market and a general declining of new jobs/incerasing in unemployment have the 10 year yield decreasing. Similarly we have now seen mortgage rates decrease as well.

How Will Decreasing Rates Impact Home Buying In Las Vegas and Henderson?

This is the million dollar question. Is it smart to wait for mortgage rates to keep lowering before buying? What we have been seeing is a steady gradual increase to the amount of homes availabe for sale and a decrease in the amount of home buyers. We haven't seen prices drastically change, the median sales price in the Las Vegas Valley has gone back and forth between $480,000 and $485,000 in 2025. The current homebuyers have benefitted from there being less home buyers in the marketplace. In general there has been the ability to negotiate. Sometimes negotiating the home price, but also negotiating closing costs, funds for buying down interest rates, terms of the sale, and even purchasing contingent on the sale of another house. While we have seen an increase in the amount of homes available for sale, it's an amount where an increase in home buyers could start to chip away at the supply. If that balance between supply and demand starts going the other way, it creates more competition for homebuyers. That means less negotiation ability and also the possibility that home prices could start trending up again.

There's No Crystal Ball, But...

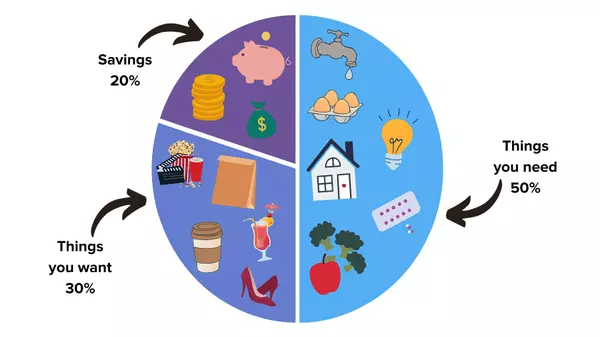

I'm not a fan of the "date the rate, marry the house theory". As we've seen over the past 2 years, when many believe rates are going to come down, some new data or world event can change things all over again. Many have been saying rates will start coming down for multiple years only to have them hold steadily. What I am a fan of? When there's a need or strong desire to purchase a home and it is possible to make it work logitically and financially, make it happen. There's a reason for the saying "Don't wait to buy real estate, buy real estate and wait". I believe purchasing a home can be beneficial long term financially, but also personally for quality of life. If it is possible to make it happen, go for it. Waiting on a good thing for a slightly better interest rate for my personal taste isn't worth the trade off. On the back end, if it makes sense to refinance and get a better interest rate you can count it as a bonus to the great house you got. The primary role of the house you live in is actually living in it...your lifestyle, shelter, and comfort. The longer term financial benefits are a secondary piece of the puzzle.

If you have questions specific to mortgage options and rates, I can put you in touch with mortgage lending specialists. If you'd like to discuss your specific home buying needs and wants and how to make them a reality I am happy to assist.(725)239-9919

Categories

- All Blogs 27

- Affordability 7

- First-Time Buyers 6

- Henderson Real Estate 13

- Home Buying 22

- Home Selling 4

- Las Vegas Real Estate 9

- Market Trends 7

- Market Updates 7

- New Construction 4

- Real Estate Tips 5

- Relocating To Las Vegas & Henderson 5

- Relocating To Las Vegas & Henderson, NV 2

- Relocation Advice 4

- Summerlin Real Estate 1

Recent Posts