The 2025 Guide to Henderson and Las Vegas Closing Costs: What Every Buyer Should Know

Closing Costs: What Every Buyer Should Know

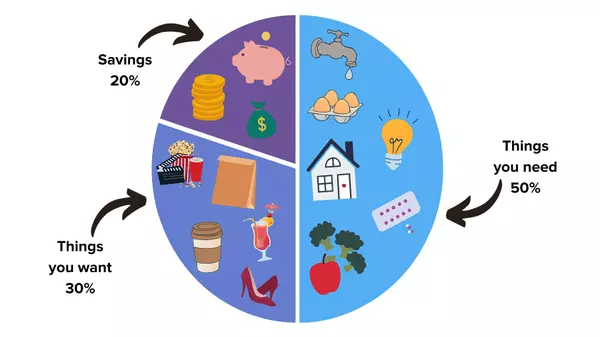

Most buyers focus on the down payment when they start planning for a home purchase. But the other big number you need to budget for is Closing Costs.

Closing costs are the collection of fees and expenses due when you finalize your home purchase. In Henderson and Las Vegas, they usually run between 2%–4% of the purchase price. On a $500,000 home, that’s anywhere from $10,000 to $20,000.

If you’re not prepared for them, they can be a budget-buster. If you understand them early, they can be managed and even reduced.

Breaking Down Closing Costs in Southern Nevada

Here’s what typically makes up your closing costs:

1. Loan Origination & Underwriting Fees

This is what your lender charges to process and underwrite your mortgage. It can range from 0.5% to 1% of the loan amount. The interest rate is not the only thing to shop iff you are comparing lenders. The fees can many times be the difference.

2. Title Insurance

Protects both you and the lender from potential ownership disputes. In Clark County, the cost depends on the sale price, but it’s a one-time fee.

3. Escrow & Settlement Fees

In Nevada, escrow companies handle the money, paperwork, and legal recording of the sale. Typically, fees are split between buyer and seller, but it’s a negotiable item in the purchase contract.

4. Recording Fees

Paid to the county to make your purchase official in public records.

5. Prepaid Items

This includes property taxes, homeowner’s insurance premiums, and in some cases, HOA dues collected upfront to fund your escrow account.

How Henderson & Las Vegas Buyers Can Lower Closing Costs

Negotiate Seller Credits

In 2025, many sellers and home builders are willing to offer credits toward closing costs to help attract buyers. We’re seeing this especially in Henderson and newer Las Vegas communities like Skye Canyon.

Shop Lender Fees

Different lenders have different fee structures. Comparing at least 2–3 options can save you thousands.

Take Advantage of Builder Incentives

Incentives in Inspirada, Cadence, Black Mountain Ranch, and Summerlin West often include thousands toward closing costs if you use their preferred lender.

Use Your Agent Strategically

Your agent (that’s me) can help structure your offer to maximize credits while still staying competitive. Even with new construction homes, there can be negotiations on terms that can be beneficial.

Why Closing Costs Matter Beyond the Numbers

Understanding your closing costs early isn’t just about avoiding surprise expenses. It gives you more flexibility. If you know your costs ahead of time, you can adjust your down payment strategy, negotiate more effectively, and be ready to close without last-minute stress.

Final Take

Closing costs are part of every home purchase, but in Henderson and Las Vegas, knowing how they work and how to reduce them can make a huge difference. With the right strategy, you can walk into your new home with more cash left over for furnishing your home, making some changes to the home, or a larger down payment. These are party of the insights and planning that should be discussed in your preliminary consultations. Setting the stage for a game-plan to succesfully purchase your next home.

Categories

- All Blogs 27

- Affordability 7

- First-Time Buyers 6

- Henderson Real Estate 13

- Home Buying 22

- Home Selling 4

- Las Vegas Real Estate 9

- Market Trends 7

- Market Updates 7

- New Construction 4

- Real Estate Tips 5

- Relocating To Las Vegas & Henderson 5

- Relocating To Las Vegas & Henderson, NV 2

- Relocation Advice 4

- Summerlin Real Estate 1

Recent Posts